Current Incentives (from July 1, 2025)

Priority Hiring Incentive

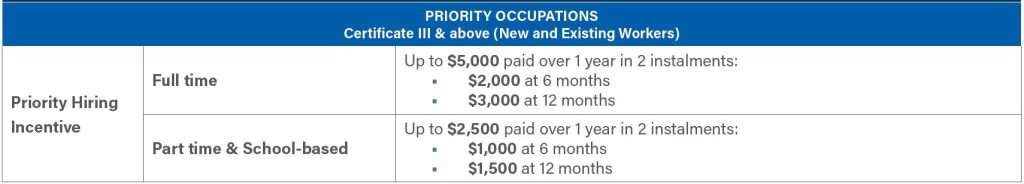

The Priority Hiring Incentive provides financial support for employers of Australian Apprentices employed in priority occupations. High-priority occupations can be found on the Australian Apprenticeship Priority List.

Eligibility Requirements:

For an employer to be eligible for the Priority Hiring Incentive:

- all primary eligibility requirements must be met; and

- The Australian Apprentice must, at the commencement or recommencement date of the Australian Apprenticeship, be undertaking a qualification and occupation listed on the Australian Apprenticeship Priority List; and

- The Australian Apprentice must be in-training with their employer on the claim period end date; and

- The employer must not be in receipt of the Disability Australian Apprentice Wage Support (DAAWS).

Payments are available at 6 and 12 months from the commencement or recommencement date of the Australian Apprenticeship.

Available financial support options can be found in our Guide to Incentives

Disability Australian Apprentice Wage Support (DAAWS)

The Disability Australian Apprentice Wage Support provides support to employers of Australian Apprentices with disability who are able to participate in open employment with suitable support and training.

Eligibility Requirements:

For an employer to be eligible for the Disability Australian Apprentice Wage Support:

- all primary eligibility requirements must be met; and

- the employer must:

- be paying a suitable wage of at least $216.07 per week, or its part time equivalent for the duration they are receiving DAAWS; and

- not be receiving any other form of Australian Government wage subsidy or equivalent for the same Australian Apprentice; and

- not be in receipt of the Priority Hiring Incentive (PHI).

- The Australian Apprentice must be in-training with their employer on the claim period end date.

- The DAAWS assessment must be undertaken by a registered medical practitioner or registered psychologist who is qualified to make a diagnosis of disability. This cannot be a school counsellor. The assessment of the apprentice’s needs must be genuine and not based on third party advice, or as part of a bulk assessment. Where the apprentice is under 18, they must be accompanied by their parent or guardian.

- Additional eligibility criteria will apply for Existing Worker Australian Apprentices.

Payments are available monthly to eligible employers.

DAAWS funding also provides financial assistance to Registered Training Organisations (RTOs) to support Australian Apprentices in their off-the-job training. This support can include tutorial, mentoring, and interpreter assistance, specifically tailored to address the apprentice’s individual needs and ensure their successful completion of the apprenticeship.

More Information

For more information on incentives available to employers and apprentices in the new Australian Apprenticeships Incentive System (AAIS), refer to the AAIS factsheet, and information on Australian Apprenticeships on the Department of Employment and Workplace Relations website.

ADMS claims process

You will no longer be required to submit your claims through to BUSY At Work but will be required to lodge your claims through an online portal with the Australian Government’s ‘Apprenticeship Data Management System’ (ADMS), which will require you to set up and link to your MyGovID account. More information can be found at AustralianApprenticeships.gov.au/About-ADMS

This new process for applying for wage subsidies has been modernised and streamlined for Boosting Apprenticeship Commencements Claim Periods 6 and onwards (i.e. for wages paid 1 January 2022 to 30 June 2022) and the new wage subsidies and hiring incentives under the new Australian Apprenticeships Incentives System from July 1, 2022.

From the 9th of April, employers will be responsible for completing these wage subsidy claims using ADMS.

How to get Started

If you haven’t already, your business will need to create a myID Digital Identity and connect it with your business using the Relationship Authorisation Manager (RAM).

How to get started with ADMS

To securely access ADMS, users will need to:

- Create a Digital Identity with myID,

- Connect your myGovID with a business through the Relationship Authorisation Manager (RAM), and

- Register for an ADMS account on the employment System Access Management (eSAM) portal.

Once your ADMS account has been set up by following the above steps, you will be able to access ADMS at any time.

MyID is your digital identity and makes it easier to prove who you are online – it’s like the 100-point ID check but on your smart device.

To access ADMS, your myID Digital Identity will need to be standard identity strength or above.

To learn how to set up your myID, please visit myID.gov.au.

RAM allows business owners to link their digital identity to their business and to authorise others to act on their behalf when using participating online government services.

Claims Under Past Incentives (prior to July 1, 2024)

Employers claiming incentives for an apprentice or trainee who commenced prior to these new incentive periods, you will continue to be supported under the prior incentives.